While some people tend to think about branding as an intangible asset, the impact it has on M&A gets very concrete once the process gets activated. Branding itself has shown to be responsible for 42% swing in company value after merging. Let us repeat that again: Thorough branding before, during and after the M&A process can improve your company’s chances of success by 42%. If you want to get down to details, the right brand decision can account for an extra 23% to the post-M&A shareholder value of a corporation – while the wrong branding-related decision can cut the value back by 19%. The numbers talk for themselves: Get the branding part of the puzzle right and chances are that the M&A will have a much higher likelihood of success. But how to go about that? That’s a good question, and one that we will entertain in this article.

Market your company, like you would market your house

Well before the merging or acquiring begins, you should investigate what’s going on with your brand, and improve it where you can. Where is it obsolete? Where can you make it shine? Think of it as selling your own house. What would you do? Most of us would naturally start looking for the broken parts and pieces and repair them, and put the whole place in order as much as we can, so that its potential and real value can sparkle through every piece of furniture. Over to your company now – it’s fundamentally the same thing. It can be boiled down to two things:

a) Show the hidden gems

Or rather, stop keeping secrets. What are the things in your company that work really well, but people outside of it dont really know about it? Tell the story of your company, and tell it well. A strong brand is about pin-pointing and expressing the authentic value it brings to the market, and doing it in an impactful way – through the right means – and at the right time.

b) Repair the rest

Okay, so your brand is not as strong as it could be – but good news, nothing is lost. If you are willing to get your hands dirty, you can still trigger the full potential of the transaction. The important thing is to start from the inside out, and way before the M&A launch.

Bulletproof M&A brand in 4 steps

Creating a powerful brand that will shoot your M&A deal to unforeseen heights is possible. But it’s not easy: it’s a joint endeavor, and it’s about digging deep into the issues, collecting insights, and from there building a strategy that the stakeholders can align with. Its also staying consistent once the merger and acquisition days are over, and keeping up with the right brand solutions from then onwards.

Let’s have a look at the four steps that you need to keep in mind from the moment of considering M&A for your company up to the point of the first day official launch:

1. Collect insights

In the beginning of M&A process, collect as much information as possible from employees, customers, or stakeholders. Ideally all three. There is a time to listen and a time to lead. While this process does not need to be lengthy nor expensive, understanding the standpoint of all groups involved is pivotal at this stage, in order to create a successful brand further on.

2. Revisit the core

It’s often a good idea to review whether the mission, vision and purpose statements of your company are up to date. New emerging leaders, top talent and ideally the wider workforce should get involved in the process. Launch the brand internally first and get everyone in the organization on board before an external launch.

3. Define the architecture

The insights you gathered in step one and two should provide you with enough data to define what best suits your M&A deal.

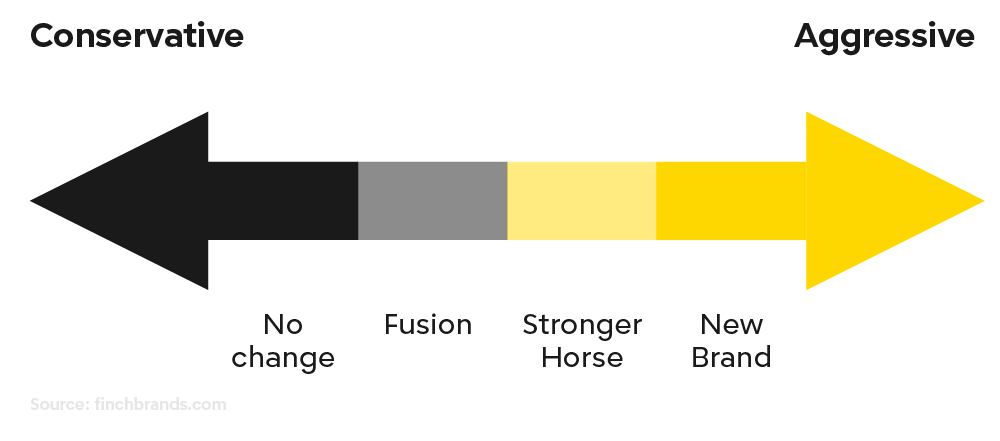

To help you decide, here are the four most prevailing strategies :

a) No change

the merging companies leave each other’s brands alone, aiming for a house of brands solution.

b) Fusion

Both companies fuse their brand assets into an evolved identity conveying its connection to heritage of the two companies.

c) Stronger horse

One brand takes over. While this approach requires a serious amount of communication internally as well as to the outside world, it can be a great opportunity for weakly established brands.

d) New brand

While this is the riskiest and the most time-consuming alternative of all strategies mentioned – creating a completely new brand can also yield the most fruitful and transformative results.

4. Maximize day ONE

Get the most out of the attention that is spurred by M&A. Internally, it means creating an opportunity for the entire organization to celebrate the rebirth of the company. Externally, it means making it real for your customers. While it is ideal that you engage with your audience in a continuous, positive and reassuring conversation starting at the M&A announcement, the moment of Day 1 should widely stand out. A good way to achieve this is to update the look and feel of your brand – and launch it on the first day of your new, merged brand. In parallel, this gesture also gives assurance to the acquired company that their integration matters in the overall picture.

M&A provides a challenging, yet rewarding opportunity to revisit your brand in order to make it stronger, more authentic and up-to-date. When employees, customers and partners get the chance to gather around a common goal, many of them will become trusting advocates for the new brand, and they will happily cheer for the new direction of the company. This will be critical for a frictionless ride as the M&A sets about, and it will also keep your talent losses and employee disengagement at bay.